- Research

- Open access

- Published:

The impact of monetary policy interventions on banking sector stocks: an empirical investigation of the COVID-19 crisis

Financial Innovation volume 10, Article number: 44 (2024)

Abstract

The enduring impact of the COVID-19 crisis on the financial sector is undeniable, persisting far beyond the eventual waning of the pandemic. This research examines central bank interventions during the pandemic, using a quantitative event study approach over a five-day window to analyse the impact of 188 monetary policy announcements on banking stocks in China, the U.S., and Europe. Our results demonstrate how monetary policy announcements targeting different economic mechanisms have produced a diverse market reaction throughout the COVID-19 pandemic. Namely, cuts in interest rates and the maintenance of a low interest rate environment by the Federal Reserve resulted in negative abnormal returns in the U.S.A., while short-term announcements surrounding intra-day credit and liquidity provisions boosted banking sector stock prices. In Europe, a muted reaction by the banking sector was observed, with negative abnormal returns observed in response to the ECB’s 2% inflation objectives. Finally, banking stocks in China responded strongly and positively to foreign currency and exchange-related announcements by the People’s Bank of China. The results and insights from this analysis can thus inform preparations made by policymakers, governments, and financial market stakeholders in the event of future waves of COVID-19, or further extreme societal disruptions.

Introduction

Financial crises have long presented society with the opportunity to assess the effects of infrequent and severe events on stock market performance. The COVID-19 pandemic presents a unique environment for investigation, as the origin of this global phenomenon lies far outside the bounds of the financial sector. Shocks and crises are invariably divided into two types: endogenous and exogenous, whereby endogenous originate within the economic system, and the latter do not (Danielsson and Shin 2013). Therefore, the COVID-19 pandemic and the subsequent economic fallout differ from previous crises such as the Global Financial Crisis of 2008 (GFC), which in contrast originated from deep within the economic system. Research has found that COVID-19 originated not only outside the bounds of the financial sector but arguably outside the rational bounds of human control (Worobey 2021; Gao et al. 2022; He et al. 2022). COVID-19 presents a unique opportunity to assess the effectiveness of economic policy interventions in response to exogenous shocks such as this, which have the potential to significantly impact financial markets. Uniquely, this crisis was followed by a prolonged period where travel and commerce were curtailed significantly, and society was sequestered into domestic ‘lockdowns. While attempting to reduce the impact of the pandemic through the implementation of lockdowns, governments also sought to restore calm, confidence, and liquidity in the economic system through timely and significant monetary policy decisions. As such, this nexus of events as the pandemic took hold created a set of unprecedented economic conditions and societal dynamics propitious for empirical investigation.

The objective of this analysis is to investigate the impact of monetary policy events implemented during the COVID-19 pandemic on banking sector stocks. We examine two key research questions surrounding financial markets and the COVID-19 pandemic. Firstly, did the announcement of major monetary support policies in response to COVID-19 significantly impact the performance of banking stocks? Secondly, does this impact differ across policy categories when examining three separate geographical and currency areas? To address these questions, we utilize an event-study technique to measure the abnormal returns of banking stocks surrounding major monetary policy announcements during the COVID-19 pandemic. We have compiled a total of 188 announcements made by the Federal Reserve, the European Central Bank (ECB), and the People’s Bank of China (PBoC). Using these, we investigate abnormal returns on banking stocks and adopt a short five-day (− 1; + 3) event window. Justification for this event window length is grounded in methodological precedents from the current literature and emerging studies which show that news throughout the pandemic was digested swiftly by the volatile financial markets which were present as the pandemic took hold (Thorbecke 2022; Alam et al. 2020; Khatatbeh et al. 2020; Rahman et al. 2021). As news and sentiment shifted frequently during the pandemic, we adopt a short event window to capture the volatile nature of these pandemic developments. Carvalho and Azevedo (2008) suggest using short event-windows, arguing that the event window should be short enough to not be contaminated by other innovations present in the market. Adopting a market model approach and utilising broad-based equity indices as regional benchmarks, we investigate abnormal returns of banking sector stocks on the day before, the day of, and three days after major monetary policy announcements in response to the COVID-19 pandemic.

For this analysis, the returns on major banking stocks in China, the U.S.A., and Europe are investigated, in response to major policy announcements by the People’s Bank of China, Federal Reserve, and European Central Bank, respectively. The focus on the financial sector and banks in particular echoes previous literature conducted on financial crises and economic policies (Ricci 2015; Fiordelisi et al. 2014; Sun and Liu 2016; Gaganis and Molnar 2021). Banks are a critical component of an economy’s financial system, acting as lenders, custodians of their customer’s deposits, and managers of financial infrastructure. Consequently, they are often at the heart of economic crises. Banks generate revenue, and by proxy financial returns, through the creation of loans. This is an activity significantly reliant on robust liquidity within the financial system. This liquidity, incidentally, is heavily reliant on expansionary or contractionary monetary policy measures undertaken by its central bank. Given this, it can be suggested that the performance of the banking sector during times of crisis is a useful indicator to financial markets on the credit quality, stability of liquidity, and fears of banking insolvencies that exist in the wider financial system. Kashyap and Stein (1997) state that the new theory of monetary policy asserts that the role of the banking sector is central to the transmission of monetary policy. As such, stocks within the banking sector have been chosen for this COVID-19 analysis in order to investigate the impact of monetary policy announcements on this critical sector of the economy during a time of unprecedented uncertainty and volatility. We theorise that if the aim of these monetary policy supports was to provide stability, assurance, and confidence to financial markets, then it is plausible to assume the presence of positive abnormal returns surrounding these announcements as markets digested this news. In this study, individual datasets containing large-cap banking stocks listed on major stock exchanges in each region have been constructed, which were subsequently measured against a regional broad-based equity index for the calculation of abnormal returns in the wider financial market.

Our results indicate a mixed reaction of banking stocks to the monetary policy announcements made in their respective region. The announcement of interest rate reductions and the maintenance of a low interest rate environment did not result in an expected positive return to banking stocks. Conversely, a negative cumulative abnormal return of -1.03% was observed for the case of the U.S.A. Additionally, lending operations announcements, through which liquidity and credit facilities were boosted, resulted in a negative return in the U.S.A. (− 1.6%) and China (-0.45%), arguably driven by the timing of the announcements in the early stages of the pandemic as global stock markets suffered significant concurrent losses (Fig. 8). In Europe, banking stocks reacted significantly to the ECB’s adoption of a symmetric 2% inflation target over the medium term, with the announcement emphasizing the need for forceful and persistent monetary policy action to prevent deviations from this target. This occurred at a time when inflation metrics were visibly increasing. Consequently, the market responded negatively, resulting in a cumulative negative return of approximately 4% over the event window. Finally, for China, the strength of the Yuan and the announcement of foreign exchange policy initiatives dominated the reaction of banking stocks, with significant abnormal returns observed in response to foreign exchange initiatives (+ 1.17%) and foreign currency deposit requirement ratio increases (+ 1.54%). Sects. "Outline of AAR and CAAR results" and 5.2 discuss the results from each monetary policy category in detail.

In this study, we contribute to the existing literature on the GFC and COVID-19 pandemic by examining varied market reactions to announcements across regions and monetary policy categories. Niewerburgh et al. (2006) argue it is conceivable that causality proceeds in both directions simultaneously, whereby stock markets are a leading indicator of economic activity, and vice versa. As such, this research quantifies the response of stock markets to the unprecedented economic shock of the pandemic and the subsequent policy responses, to inform preparations by governments, regulators, and relevant stakeholders in the event of future ‘waves’ of COVID-19, or further extreme societal disruptions. We find that foreign exchange-related announcements by the PBoC positively impact banking sector stock prices, emphasizing emerging markets' vulnerability to foreign currency deposit shocks. In the U.S.A., intra-day credit and liquidity provisions have a positive effect on banking sector stock prices, highlighting their importance in mitigating volatility and boosting confidence in the banking sector. However, negative stock returns in the EU following inflation-related announcements signal the need for policymakers to closely monitor systemic risks within the banking sector, considering the potential effects on financial stability. Striking a balance between controlling inflation and maintaining financial stability is crucial. This knowledge informs the current body of literature and provides guidance to interventions aimed at stabilizing financial markets, supporting economic recovery, and ensuring the financial sector's resilience in the face of future crises or societal disruptions.

Secondly, the pandemic led to transformative changes in financial markets globally, driven by increased interconnectedness and interdependence due to globalization and technological advancements. Financial contagion and systemic risk have become pressing concerns (Corbet and Goodell 2022). Our study offers valuable insights by analysing the diverse impact of monetary policy announcements on banking sectors during the pandemic across three regions and distinct policy categories. Understanding the nuanced reactions to policy measures guides future pandemic responses and aids financial market stakeholders and policymakers, enriching the broader framework of financial market interdependence for an evolving global economy.

Our findings underscore the importance of monetary policy coordination and understanding cross-border implications in the interconnected global financial markets. The varied impacts of different monetary policy announcements in China, the U.S.A., and Europe highlight the complexities of interconnected financial markets. As financial markets have become more intertwined, reactions to policy measures in one region can affect others, leading to diverse outcomes across economies. Policymakers should consider potential spillover effects on other economies, recognizing the opportunities and challenges posed by financial market interdependence when devising crisis mitigation strategies.

The study proceeds as follows. Sect. "Past literature" summarises the current literature available on this research topic. Sect. "Data" describes both the event data and financial market data used in this analysis. Sect. "Methodology" describes the empirical methodology employed in this investigation. Sect. "Empirical results" outlines the results while Sect. "Discussion and implications" explores the findings and the implications which can be drawn in the context of the macroeconomic landscape during COVID-19. Sect. "Conclusion and avenues for further research" concludes the analysis.

Past literature

Akin to previous crises, an abundance of literature has emerged on COVID-19 and financial markets, highlighting the uncertainty, volatility, and economic damage that emerged as the virus took hold and spread into a global pandemic (Zhang et al. 2020; Al-Awadhi et al. 2020; Goodell 2020; O’Donnell et al. 2021; O’Donnell et al. 2023; Ashraf 2020; Ashraf 2021; Ali et al. 2020). The following sections will dissect the current literature in this study’s scope, with respect to both historical periods of crisis in financial markets, and current research emerging from the COVID-19 pandemic.

Monetary policy and event-study analysis in finance

Monetary policy or monetary expansion by a central facility is an increase in the money supply to target the level of interest rates or economic output. On the other hand, fiscal policies are implemented at a governmental level, representing decisions on taxation and spending. While both monetary and fiscal policies are used to regulate economic activity, monetary policy will be the focus of this paper due to the open market nature of its operation, and the key role it plays to achieve price, inflation, and consumption stability during economic fluctuations; a pertinent area of focus during the COVID-19 pandemic. Expansionary monetary policy involves, but is not limited to, a central bank either buying bonds on the secondary market, decreasing interest rates, or reducing the reserve requirement of banks. All things equal, these actions increase the money supply and lead to lower interest rates. This increases liquidity and creates incentives for banks to loan and for businesses to borrow. By proxy, these debt-funded expansions can positively affect consumer spending and investment through employment, thereby increasing the aggregate demand within an economy. Given the simple theoretical basis of monetary policy, however, Jannsen et al. (2019) stress that in times of crisis and uncertainty, the effects of monetary policy differ substantially from those in normal times. Examining the GFC, the effects of monetary policy shocks were observed to be significantly larger than in normal times. Namely, on measures of economic output, prices, credit spreads, asset prices, and consumer confidence. The importance of the timeliness of policy implementations was also highlighted, whereby the ECB reacted later than the Federal Reserve, with the latter mitigating the biggest drop in output. These findings are in line with those of Mishkin (2009) who criticise the fallacy that monetary policy is ineffective during times of crisis, as this may promote inaction when it is most needed; a theme of criticism especially salient during the COVID-19 pandemic. In the context of financial markets, comparisons have been drawn in the literature between the recent COVID-19 crisis, and the GFC (Allen-Coghlan and Varthalitis 2020; Gunay and Can 2022; Shibata 2020; Jebabli et al. 2022). Given this current theme in the emerging literature, the following section will examine historical research on this topic through the lens of the GFC.

Using an event-study analysis, Ricci (2015) investigated cumulative abnormal returns (CARs) around monetary announcements and found a significant stock price reaction within the banking sector, whereby increased liquidity provisions by the ECB decreased banking sector stock prices in the Euro area. Similarly, Fiordelisi et al. (2014) analysed abnormal returns and used a comprehensive dataset encompassing five-years of monetary policy announcements across five individual currency areas. Here, it was found that standard monetary policy measures were effective at maintaining and restoring the interbank market during the GFC. Meanwhile, non-conventional measures led to stronger reactions within stock markets. In the context of COVID-19, both standard and non-conventional measures were used extensively to quell the market disruption that transpired. Standard policy measures target the control of short-term interest rates, open market operations, and bank reserve requirements. However, in times of deep financial turmoil, conventional policies display weakness and a distinct reduction in efficacy as crises sustain, as found by Hubrich and Tetlow (2015). As such, when central banks and conventional policies reach the upper bounds of effectiveness, non-conventional policy measures will be employed to maintain economic and financial stability. Non-conventional monetary policies include the targeting of long-term interest rates, the restoration of liquidity conditions, asset prices, and credit spreads (Potter and Smets 2019). As such, alongside conventional tools, the COVID-19 pandemic and knock-on economic impacts launched an unprecedented wave of unconventional policy measures (Cortes et al. 2022; Wei and Han 2021; Bhar and Malliaris 2021; Vásconez et al. 2021).

Examining unconventional monetary policy decisions in the United States, the United Kingdom, the Euro area, and Japan, Ait-Sahalia et al. (2012) found interest rates cuts and bank recapitalisations as the most promising policies to alleviate financial market distress and liquidity risk premia during the GFC. As Drechsler et al. (2018) find, a higher liquidity premium adds to the cost of leverage, leading to less risk-taking, higher risk premia, lower asset prices, and less investment. Jawadi et al. (2010) denote the same response, whereby the UK, US, and French markets showed strong repercussions to interest rate changes during the GFC. The literature is abundant with similar findings, highlighting the significance and effectiveness of unconventional monetary policies and the mechanism of monetary policy transmissions to financial markets (Bernanke and Kuttner 2005; Chulia et al. 2010; Maio 2014; Chodorow-Reich 2014; Jiang and Wang 2017). This study adds to this current body of literature, examining the significance of five categories of monetary policies used throughout the COVID-19 crisis.

Emerging literature from the COVID-19 pandemic

The body of literature investigating this research topic in the context of COVID-19 is growing. (O’Donnell et al. 2021, 2023) investigate the COVID-19 pandemic through the lens of global equity indices. Their findings show a distinct significance of both COVID-19 case growth and COVID-19 vaccination growth. These indicators of pandemic developments affected stock markets in global epicentres of the virus negatively and positively, respectively. Notably, this effect was sustained while controlling for volatility, investor sentiment, credit risk, liquidity risk, monetary policy, safe-haven asset demand, and the price of oil. Chen and Yeh (2021) studied industrial reactions to both the GFC and the COVID-19 crisis using an event-study methodology, finding a significant negative impact from both events on stock market performance. However, market performance subsequently recovered following quantitative easing measures, a finding echoed by Heyden and Heyden (2021). The former assesses the recent pandemic at an industrial level, while the latter investigates the reaction of US and European stocks at the beginning of the pandemic.

Huynh et al. (2021) investigate sectoral performance and government interventions during the COVID-19 pandemic in Australia. The results indicate contrasting impacts across sectors. Sectors benefiting from government financial assistance displayed resilience and less severe effects from the pandemic, while industries without direct financial remedies did not. Similarly, Kakhkharov and Bianchi (2022) analyse Australian bank and FinTech stock prices, complementing the above findings by emphasizing the sensitivity of these stocks to macroeconomic announcements and containment measures, suggesting a need for effective macroeconomic announcements as a stabilizing tool during crises. Zaremba et al. (2021a) examine the role of government policy responses in reducing volatility in international sovereign bond markets during COVID-19. The study demonstrates that government interventions substantially reduce local sovereign bond volatility, particularly economic support policies. Examining the influence of government policy responses on global stock market liquidity, Zaremba et al. (2021b) highlight a limited impact of interventions, with workplace and school closures deteriorating liquidity in emerging markets. Conversely, pandemic-related information campaigns facilitated trading activity.

As the focus shifts toward monetary policies in response to crises such as COVID-19, Cortes et al. (2022) investigated the spill-over effects of unconventional policy interventions conducted by the Federal Reserve in response to the COVID-19 crisis. Positive spillovers into US equity markets were observed in response to COVID-19 crisis interventions. In contrast, Wei and Han (2021) found that the emergence of the pandemic weakened monetary policy transmission, as unconventional monetary policy became less effective across global markets, echoing Ozili and Arun (2020). Here, it is suggested that stronger policy adjustments may be needed to achieve the desired effects and rebalance the transmission of monetary policies going forward. On the other hand, in emerging markets, Fratto et al. (2021) found that unconventional monetary policies through asset purchase programs were significant at reducing bond yields to a higher degree than policy rate cuts, thus reaffirming the aforementioned studies, which highlighted the importance of unconventional monetary policy during times of distress.

Rebucci et al. (2022) uncover the sustaining utility of quantitative easing initiatives throughout different stages of the pandemic in both advanced and emerging financial markets. The findings emerging from the pandemic largely concur with the literature available from the GFC. The comparison of these two financial crises presents challenges to out-of-sample validity, however. While the GFC originated within the economic system in the sub-prime mortgage sector, the COVID-19 pandemic originated as a public health crisis before spreading into a widespread economic crisis. As such, caveats must be made in any comparison of these two events. This analysis contributes to this gap in the literature by evaluating economic interventions in response to COVID-19, spanning from the beginning of the pandemic in January 2020 until December 2021. Tan et al. (2021) draw lessons from the GFC and examine the impact of government interventions on bank markups. Interestingly, the study finds no evidence of an increase in markups, with longer and larger interventions having no significant impact on prices. However, increasing costs due to higher loan impairments, lead to lower markups. This result aligns with Marobhe and Kansheba (2022), who demonstrate a significant positive stock market reaction to stringent country-level containment measures during the first wave of COVID-19. Moreover, it was found that stock market interventions, such as short-selling bans and circuit breakers amplified the positive effects of containment measures on stock market performance. However, a study by Singh et al. (2021) into the effectiveness of policy interventions during COVID-19 in China and Russia offers contrasting results. The study finds interventions to be effective in China but less so in Russia, where greater global links were evident. This discrepancy highlights the importance of considering global market linkages when addressing the impact of crises, an aspect emphasized in the other literature discussed in this study. For instance, Aharon and Siev (2021) explore government interventions in emerging countries and their impact on stock market performance during COVID-19, revealing that government restrictions are associated with negative market returns, particularly evident when closures are imposed. These findings were shared by Aharon et al. (2021) examining the hospitality industry in isolation. Similarly, Rubbaniv et al. (2020) examine European stock markets, observing that interventions by central banks have mixed effectiveness in mitigating the adverse impact of COVID-19 on stock markets.

In the wake of COVID-19, the topics of contagion, peer effects and risk spillovers have come to the forefront of attention for scholars, policymakers, and investors alike. Bouzzine and Leug (2020) focus on the contagion effect of environmental violations, using the Dieselgate scandal in Germany as a case study. They reveal that the financial implications of such scandals spread to industry peers, with Volkswagen suffering immediate financial damage upon the initial event, while subsequent events had significant effects on its peers. Corbet and Goodell (2022) explore the reputational contagion effects of ransomware attacks, finding that investor attention events have a broader impact than previously acknowledged, spreading not only between directly impacted firms but also to their competitors with significant ownership stakes in the affected firms. Nguyen and Nguyen (2022) explore the relationship between uncertainty and corporate default risk in emerging markets. The results show a positive association between uncertainty and firm default risk, with the impact being more pronounced for the lowest and highest-risk firms. Mugerman et al. (2014) investigate long-term savings decisions and how financial reform and peer effects influence these choices. The study highlights that individuals' savings decisions were strongly affected by their social environment, with co-workers from the same ethnic group having a significant influence on fund choices. Additionally, Mugerman et al. (2022) illustrate how mutual funds denoted as those with high exposures to corporate bonds beyond their equity limits suffer from significant decreases in daily net in flows. The increased visibility of this risk-related information highlights how the influence of peer effects within industries can become even more pronounced during crisis periods.

Extending the literature to COVID-19, Corbet et al. (2022) investigate the presence of financial contagion among several COVID-19-related indices during the pandemic. This study finds significant contagion effects, measured through correlation and coskewness, among various COVID-19 concept-based indices. The presence of structural breaks suggests a flight to safety during the crisis, with risk-averse investors leaving the market en-masse. Their results provide evidence of contagion effects, robust across crisis and non-crisis periods, offering valuable information to investors and policymakers in evaluating response mechanisms during major crises. Yijun et al. (2023) explore the contagion effect of risks in the Chinese banking industry before and after the outbreak of COVID-19. Using transfer entropy and social network analysis methods, the study finds that the risk of inter-bank system increased significantly after the outbreak, with changes in key nodes of bank risk contagion. State-owned banks appear less risky, while joint-stock banks and local financial institutions show higher risk levels, indicating asymmetric contagion effects between banks. Similarly, Gunay and Can (2022) evaluate the COVID-19 pandemic and the GFC in terms of financial contagion and volatility spillovers in global stock markets, identifying the US stock market as the source of financial contagion and volatility spillovers during both crises. Meanwhile, Nguyen et al. (2022) examine financial contagion from the US, Japanese, and Chinese markets to Asian markets. During the COVID-19 pandemic, only three out of ten Asian emerging markets experienced contagion from the US, suggesting that contagion effects are not solely determined by the level of global integration. Interestingly, Asian markets seem to be more affected by contagion from Japan and China during the pandemic.

In the context of this study, it becomes evident that the interconnectivity of global financial markets accentuates the importance of monetary policy coordination and the cross-border implications of policy measures. The diverse impacts observed from various types of monetary policy announcements in this study and in the current literature illustrate the complexities inherent in financial markets. As these markets have grown more interwoven, the responses to monetary policy measures in one region can resonate across others, resulting in diverse outcomes among different economies. As such, the individual findings from this study for each region provides insights to both policymakers and investors alike, underscoring the need for policymakers to consider the potential spillover effects of their actions on other economies during times of crises.

Data

Event data

As Jiang and Wang (2017) outline, the transparency of monetary policies has increased significantly in recent years, consistent with one of the major roles of monetary policy itself: to sustain financial stability. With this increased transparency, the examination of announcements by central facilities presents an insightful opportunity for the analysis of both market expectations and market reactions, and the subsequent impact these announcements have on financial market returns. In this study, we examine the monetary policy interventions during the COVID-19 pandemic for three distinct geographical and currency regions: the U.S.A., Europe, and China, examining the almost 2-year period between January 2020 and December 2021. This time frame was chosen to capture the period from the very beginning of the pandemic and the 2-year period which followed. Data on major policy initiatives has been compiled from various central bank resources including the Federal Reserve, the ECB, and the PBoC by Cantu et al. (2021). We employ this standardized dataset in our analysis which contains announcements between January 2020 and December 2021. China (PBoC), the U.S.A. (Federal Reserve), and Europe (ECB) were chosen for this analysis as the current three largest economic regions in the global economy. As such, it stands to follow that the selection of these three distinct currency areas will offer the most prominent and powerful policy guidance on the global macroeconomic response to COVID-19. Current data provides only the date (and not the intra-day timing) of each announcement, limiting this analysis to daily frequency. Each announcement has been classified as belonging to 1 of 5 major policy categories, each defined in Table 1. In total, 188 announcements (PBoC: 35; ECB 59; Federal Reserve: 94) across the three regions are used to quantify whether major policy initiatives in response to the COVID-19 pandemic had a significant impact on the price and daily return of banking stocks. Summary statistics of the event data following categorization and collation are provided in Table 2.

Financial market data

To assess the equity market responses to policy announcements, daily stock price data on large-cap banking stocks listed in the U.S.A., Europe, and China were gathered, encompassing the data range between January 2020 and December 2021 in line with the announcement data compiled. A total of 44 individual banks across the three regions are examined, representing the large-cap banking sector in each region. Large banks, measured through their market capitalization, were analysed in this study. Our sample includes commercial, retail and investment banking firms, offering a wide array of banking, wealth management and brokerage services to customers. The literature states that the size of a bank is directly related to the level of systemic risk associated with it (Gandhi and Lustig 2015). As such, existing literature supports the notion that large banks play a significant role in generating systemic risk and constitute a substantial portion of the overall market risk within the financial sector (Laeven et al. 2014; De Jonghe et al. 2015). Therefore, we chose large banking stocks in this analysis to represent those banks most systemically important to the financial sector. By selecting a sample comprised of the largest banks, a notable advantage is that the analysis avoids an overrepresentation of the impact of smaller, riskier banks when assessing the effects of monetary policy announcements. This dataset was compiled using a Bloomberg terminal. Where data availability permitted, we sourced daily stock price data for banking stocks in each region, once ranked by market capitalization. For the purpose of the event-study and the analysis of market-adjusted returns, a regional broad-based equity index for each respective area was also gathered. Namely, the S&P 500 Index for the U.S.A., the European STOXX 600 Index for Europe, and the MSCI China A Index for China. As such, we have a sample of 44 individual banks, with each bank per region reported in Table 3. Descriptive statistics illustrating the performance of the banking sector throughout the pandemic period are shown in Table 4. As per the descriptive statistics in Table 4, stock market returns in the pre-pandemic period between January 2019 and January 2020 were negative for all three regions. Europe suffered the worst average daily performance, while the U.S.A. had the least negative daily return of the three regions examined. In line with this, Europe experienced the highest volatility during this period as per the standard deviation of returns, while China experienced the least. In terms of the event period analysed, throughout the entire pandemic up to December 2021, higher standard deviations of returns were observed for all regions, relative to the pre-pandemic phase, indicative of the increased volatility of financial markets during this time. This is also evidenced by the significantly higher minimum and maximum returns observed in all regions during this period. However, it is noteworthy to highlight the positive daily returns observed in both Europe and the U.S.A. This may be explained by the significant V-shaped recovery which took place following the initial shock to financial markets, whereby markets recovered significantly while the pandemic continued to grow and persist (Mahata et al. 2021). China, however, continued to experience negative returns during this period, with average daily returns remaining negative to a higher degree than in the pre-pandemic phase.

Methodology

Event-study methodology

To analyse the effect of COVID-19 monetary policy responses, an event study including daily returns of the aforementioned banking stocks was conducted. Widely used in finance since its introduction by Fama et al. (1969), event-studies have become the standard method of measuring stock price behaviour around events such as monetary policy announcements, earnings announcements, regulatory changes, or other exogenous impactful events (Binder 1998). At its core, the event-study technique assesses the efficiency of financial markets. In other words, whether market prices truly reflect all available and relevant information. As such, from both a retrospective analysis and real-time trading perspective, such studies can be used to determine the reliability of event-driven trading strategies by identifying whether an abnormal efficiency appears as a result of new information.

Definition of event and event window

In this study, we follow (Ait-Sahalia et al. 2012; Ricci 2015; Fiordelisi et al. 2014) and adopt the short five-day (− 1; + 3) event window, where (\({t}_{1}\)= − 1 and \({t}_{2}\) = 3). As previously mentioned, justification for this event window length is derived from methodological precedents and the swift frequency that new information was disseminated to financial markets as the COVID-19 pandemic took hold. Short five-day event windows such as this have been employed in the current COVID-19 literature (Alam et al. 2020; Khatatbeh et al. 2020; Rahman et al. 2021; Thorbecke 2022). This short window facilitates an investigation into the significance of monetary policy events in a real-time trading perspective by identifying whether an immediate abnormality appears, and trading opportunities arise as a result of these announcements. Oler et al. (2007) find that the most common duration chosen for the event window is 5 days, which accounts for approximately 76.3% of the studies examined in their meta-analysis. As such, this choice of event window follows methodological precedents in the literature. Additionally, given the swift frequency of news dispersion throughout the pandemic and the general efficiency of stock markets, this choice allows sufficient time for the market to fully digest and incorporate the implications of the monetary policy announcement into banking sector stock prices. Referring to Figs. 2, 3, and 4, it becomes evident that our choice to employ a 5-day event window successfully encompasses both the prolonged response of stock returns to announcements and/or the subsequent mean reversion of stock returns to normality that a shorter event window would not capture. Thus, our selection mitigates short-term market fluctuations and daily volatility, capturing more meaningful price movements related to the monetary policy announcement. The event date is equal to \({t}_{0}\), being the date of the announcement of a new monetary policy by central banks in response to COVID-19. As such, \({t}_{-1, +3}\) are indicative of 1-day previous, to 3 days post announcement. An estimation period of 252 days or one calendar trading year was chosen to calculate the average normal returns and standard deviation of the banking stocks prior to the announcement date, in line with (McKinlay 1997). A 5-day event window with the above notation and estimation window are illustrated below in Fig. 1, for methodological reference.

A 5-Day Event Study Timeline, where the event date is equal to t0, being the date of the announcement of a new monetary policy and t (− 1, +3) indicates 1-day previous, to 3-days post announcement. An estimation period of 252 days or one calendar trading year was chosen to calculate the average normal returns and standard deviation of the banking stocks prior to the announcement date

Estimation of normal and abnormal returns

The expected return of the stock during a normal non-event period is calculated from the estimation window, or the 252 trading days before the event window using the market model approach suggested by Sharpe (1963). Dyckman et al. (1984) found that the adjusted average return model, the adjusted market return model, and the market model display the same efficacy in detecting the presence of abnormal returns. As such, the widely used market model approach using the Sharpe Single-Index Model was utilized in this analysis to control for the effect of the event on the wider market. As per the Sharpe (1963) model, the expected return on a stock can be decomposed into a firm-specific component, and a market-wide component, represented by Eq. (1).

where (\(E{R}_{i,t}\)) is equal to the expected return of stock (i) at time (t), (\({\propto }_{i}\)) is equal to the stock’s alpha or excess return relative to the market benchmark, (\({\beta }_{i}\)) is equal to the beta of the stock, or its volatility compared to the market as a whole, and (\({R}_{m,t}\)) is equal to the return of the wider market for period (t). Due to the descriptive and explanatory nature of this study, rather than predictive, the single-index model was employed. As Kliger and Gurevich (2014) state, although multifactor benchmarks such as the Fama–French 3-Factor model employ multiple factors accounting for higher proportions of return variability, they may also be more prone to larger estimation errors due to their more complicated structures. Since the scope of this analysis is to identify and quantify the impact, if any, of monetary policy announcements on the banking sector as a whole, the Sharpe single-index model was employed.

To investigate the stock price reaction of the banking sector to COVID-19 monetary policy announcements, we then estimate the abnormal returns (\(AR\)) of these stocks using a market estimation model. In such a model, abnormal returns are estimated and built on the actual returns of a broad-based index representing the wider financial market, each of which has been specified in the previous section. Abnormal returns are thus estimated by deducting the returns that would have been realized if the event or monetary policy announcement had not taken place, from the actual returns that were realized. In simple terms, the abnormal return \(A{R}_{i,t}\) is equal to (\({R}_{i,t}-E{R}_{i,t}\)). Equation (2) below formally describes this model, where the abnormal return (\(A{R}_{i,t}\)) is equal to the differential between the realized return on the stock (\({R}_{i,t}\)) on that given day and the normal return that would have occurred. This normal return is estimated from two inputs; the relationship between the stock price and the broad-based equity index represented by (\({\propto }_{i}\)) and (\({\beta }_{i}\)) and the return of the broader market, indicated by (\({R}_{m,t}\)).

Adding up each of the \(AR\) s calculated, we can create a value for the \(CARs\). In other words, the total impact of an event over the event window.

Given the sample-study nature of this analysis with multiple events of the same event type (defined in Table 1), we investigate the averaged abnormal return \(AAR\) across each event type or category of monetary policy announcement. This returns the averaged abnormal return for all N stocks for each day in the event window. This \(AAR\) is defined as:

Finally, since our event study holds multiple observations of differing event types, the Cumulative Averaged Abnormal Return (\(CAAR\)) value represents the mean value of the abnormal returns of the events across each monetary policy category and event window interval. In other words, it sums the averaged abnormal returns over each of the T days in the event window (− 1; + 3), to form the cumulative averaged abnormal return.

Hypothesis and significance testing of abnormal returns

We first define our null (\({H}_{0}\)) and alternate (\({H}_{1}\)) hypothesis as below, where (\(\mu\)) is equal to the mean of the abnormal returns being examined. As such, should the mean of abnormal returns differ from 0 with statistical significance, we can thus reject the null hypothesis and conclude that the event in question has resulted in non-zero returns, systematically different from those predicted in normal conditions.

In order to ensure the robustness and reliability of the results and to control for common event-study limitations, we implement several parametric and non-parametric event-study tests, as per Schimmer et al. (2015). Parametric tests assume that each firm’s abnormal returns are normally distributed, while non-parametric tests do not rely on the same assumptions. However, it is found consistently in the literature that daily stock returns rarely follow a normal distribution (Fama et al. 1969; Fama 1970). Despite this, Brown and Warner (1985) provide compelling evidence supporting the efficacy of parametric tests even in the presence of non-normal data. The empirical findings indicate that within a sample comprising of at least 5 securities, the distribution of positive and negative abnormal returns tends to exhibit a roughly equal proportion. Given this, as the sample size expands, excess returns converge to normality as per the Central Limit Theorem. Dyckman et al. (1984) also studied the effects of non-normality in daily stock returns and the performance of parametric tests. Here, it was found that the issue of non-normality does not significantly affect the statistical power of short-run event study methods. Moreover, parametric tests remained adequately specified under the presence of non-normality. This was also echoed by Berry et al. (1990), who specifically examined daily data and the choice of parametric versus non-parametric tests. Again, it was found that parametric tests were well specified under a variety of conditions, while non-parametric tests were not. Testing of our data revealed the presence of non-normality under the Shapiro–Wilk normality test, the results of which are available in the Appendix in Table 13 and Figs. 9, 10, and 11. However, following the aforementioned literature and methodological precedents, we implement both parametric and non-parametric tests, as per (Brown and Warner 1985; Dyckman et al. 1984; Berry et al. 1990; Fiordelisi et al. 2014; Ricci 2015). As outlined in Table 5 below, we implemented 3 parametric and 2 non-parametric event-study tests into our analysis. In the context of our analysis and the exploratory rather than the predictive scope of our research, we argue that the non-normality of our data does not present a significant hurdle to the analysis of our results. The objective of this analysis is to investigate the abnormal behaviour of bank prices surrounding monetary policy events during the COVID-19 pandemic. To do this, we used the widely implemented market-adjusted return model as outlined in Eq. 1. From this model, the non-normality of our subsequent abnormal returns indicates the existence of a significant exogenous variable missing from our model. Despite accounting for the broader market return, and the monetary policy event, the presence of non-normal abnormal returns surrounding the event date leads us to believe there are additional exogenous variables that can adequately explain the movement of banking stocks throughout the pandemic. We intend to investigate these additional factors in future research. However, for the purpose of this analysis, we focus on the single-index model outlined in Eq. 1 and examine the overarching abnormal behaviour of bank stock prices surrounding these monetary policy events. Sect. "Empirical results" outlines the results of this study.

Empirical results

Table 7 through 12 in the appendix report the AARs (7–9) and CAARs (10–12) triggered by the announcement of monetary policy measures in response to COVID-19. Each category of the announcement is highlighted in each panel, with the event day denoted as day 0 and the surrounding days in the event window denoted as − 1 through + 3, for the full 5-day event window. Figures 2, 3, and 4 accompany this section, illustrating these CAARs for each region over the event window.

Averaged Abnormal Returns for U.S.A. banking stocks over the event window durations. While an initial sharp response was observed in response to Reserve Policy announcements, this abnormality did not sustain, with no statistical significance observed over the 5-day event window. Lending Operations, Interest Rates, and ‘Other’ announcements seen above resulted in statistically significant CAARs

Varying levels of significance (denoted in bold in the tables) around the event day 0 are observed for all regions. As such, where significant p-values are detected in 3 or more of the significance tests, we deem this result as a statistically significant detection of abnormal returns in the majority of tests. As Kliger and Gurevich (2014) illustrate,Footnote 1 focusing on abnormal returns over different parts of the event window provides an insight into the varying levels of market efficiency and the evolving market reaction to the event. With this, the following section will first outline the significant AARs on each day of the event window, per announcement category and region. Accompanying p-values and t-test results for statistically significant AARs and CAARs are available in each of the tables presented.

Following this, the CAARs will be examined to determine the significance of each announcement category as a whole over every 5-day event-window. Finally, examining these significant events, we will qualitatively explore the monetary policy actions announced under these categorizations, the interactions these had with financial market returns over the event window, and explore the conclusions that can be inferred in the context of financial markets during the COVID-19 pandemic.

Outline of AAR and CAAR results

For the case of the U.S.A., Table 7 presents varying levels of significance for each announcement category. In response to interest rate announcements, banking stocks displayed abnormal returns on days − 1 (negative), 0 (negative), + 1 (negative), and + 2 (positive), with statistical significance observed in 4, 3, 6, and 5 of the 6 hypothesis tests used, respectively. In response to Foreign Exchange policy announcements, significant abnormal returns were observed on day − 1 (negative) and + 1 (positive) under 4 and 3 of the hypothesis tests, respectively. In response to announcements regarding Lending Operations, statistically significant abnormal returns were observed on days − 1, 0, + 2, and + 3, with all but day + 2 being negative. Negative abnormal returns were observed on days + 2 and + 3 for Asset Purchase announcements, while positive returns were observed on the event day 0. Reserve Policy announcements saw significant abnormal returns on days 0 (negative), + 2 (positive), and + 3 (positive). Finally, policy announcements categorized as ‘Other’ saw large and statistically significant abnormal returns on days − 1 (negative), + 1 (positive), + 2 (positive), and + 3 (positive).

Examining Table 10, the CAARs over the entire event window outline the CAAR and the significance of the policy announcement category as a whole over each 5-day event period analysed. Statistically significant CAARs under all hypothesis tests are observed for Interest Rate (− 1.03%), Lending Operations (− 1.6%), and Other (+ 3.98%) policy announcements. Each of these will be examined in further detail in Sect. "Analysis of significant event CAARs".

The reaction of European banking stocks to the ECB’s monetary policy announcements (Table 8) was significantly muted in contrast to the U.S.A. Interest Rate and Asset Purchase policy announcements saw negative abnormal returns on the event day 0 (negative) only, while no broad significance was observed in response to Foreign Exchange announcements. Lending Operations saw positive abnormal returns on day -1 (positive), before fluctuating by a similar magnitude in the preceding days 0 (negative), + 1 (positive), and + 2 (negative). Finally, announcements categorized as ‘Other’ saw more wide-ranging abnormal returns on days − 1 (negative), + 1 (positive), + 2 (negative), and + 3 (negative).

Examining the overall significance of the CAARs for Europe (Table 11) illustrates the large and statistically significant abnormal returns triggered by ‘Other’ policy announcements (-3.92%) over the 5-day event window, discussed in more detail in Sect. "Analysis of significant event CAARs".

Finally, Table 9 examines the reaction of Chinese banking stocks to the PBoC’s COVID-19 response. We observe statistically significant abnormal returns in response to Foreign Currency Requirement Ratio announcements on day 0 (positive), + 1 (positive), and + 2 (negative), while Foreign Exchange Policy events resulted in abnormal returns on day − 1 (positive) and + 1 (positive). No observable significance was observed in response to Interest Rate announcements, while both Lending Operations and Reserve Policy events resulted in a mixed response, with abnormal returns observed on days − 1 (negative) and + 3 (negative) for the former, and on day + 3 (negative) for the latter.

Table 12 denotes the CAARs observed for Chinese banking stocks. Foreign Exchange and Foreign Currency Deposit Requirement Ratio announcements resulted in the largest CAARs of + 1.17% and + 1.54%, respectively. Reserve Policy announcements also denoted a statistically significant response of − 1.02% over the event window. The following section will expand on these results and explore in more detail the dynamics of each policy type and their reported interaction with financial markets.

It is evident from the above that mixed abnormal returns, both positive and negative, surround the event date 0 across all categories. This raises questions on the evolution of market reactions and the efficiency of financial markets as a whole to the above events. Firstly, the potential for information leakage through prior warning or market expectations may result in abnormal returns prior to the event. However, the occurrence of pre-announcement abnormality may be indicative of normal market efficiency, whereby information leakage results in abnormality, which is subsequently followed by a return to normality on announcement day as the market returns to efficiency. This information leakage and the presence of pre-announcement abnormality is not uncommon in practice. Previous research highlights how institutional trading volumes not only front-run the occurrence of news announcements but can also predict the sentiment and reaction of such announcements indicating a distinct information leakage and a significant price discovery process in advance of news announcements (Hendershott et al. 2015; Christophe et al. 2010; Irvine et al. 2007). The dissemination of pandemic developments and new information in the early stages of the pandemic was swift and abundant. Due to this, longer event windows faced the limitation of overlapping events within the chosen event window. Given this, we instead follow Lucca and Monech (2014), who quantify and uncover a significant pre-announcement drift in the 24 h preceding monetary policy announcements by the Federal Open Market Committee (FOMC). As such, our 5-day event window from − 1, to + 3 captures the potential of pre-announcement abnormality as per Lucca and Monech (2014) in the day preceding the announcement. After the event date, our 5-day event window covers the subsequent days thereafter as the announcement and new information are incorporated and digested by financial markets, and where post-announcement drifts are commonly observed as the market adapts to new information.

Abnormality in returns following the event may be indicative of an overreaction or delayed price discovery process at play in response to new or unexpected information, whereby stocks react abnormally in the period directly following the event date. In the context of monetary policy decisions, Indriawan et al. (2021) investigate the returns on bond futures in response to Federal Open Market Committee (FOMC) meetings. In this study, they attribute large and significant post-announcement ‘drift’ returns to a more informed market and, thus, a more informative order flow following FOMC announcements. Investing in a strategy capitalizing on this persisting ‘drift’ yields a Sharpe RatioFootnote 2 of up to four times a traditional ‘buy-and-hold’ strategy. More commonly observed in the literature is the presence of abnormal returns following earnings announcements, or post-earnings announcement drift (Richardson and Veenstra 2022; Bernard and Thomas 1989; DellaVigna and Pollet 2009; Hirshleifer et al. 2009). Finally, the detection of abnormality on Day 0 only may be indicative of a market in full accordance with the efficient market hypothesis. In line with Fama (1970), new announcements are met with a swift and timely reaction from markets. In this case, no information leakage is evident, and no post-event overreaction is present. In the following section, the CAARs of each announcement category will be assessed in further detail, with qualitative extrapolations provided in the context of COVID-19 and financial markets.

Discussion and implications

Analysis of significant event CAARs

The following section will analyse, compare, and contrast the presence of significant CAARs in each announcement category across the three regions examined. No CAAR across all announcement categories was widely significant. Table 6 below summarises where the CAAR across the 5-day event window was on average significant, with a “Y” indicating significance, an “N” indicating a lack of significance, and a “N/A” indicating no relevant events in that region for that announcement category.

‘Other’ economic policies

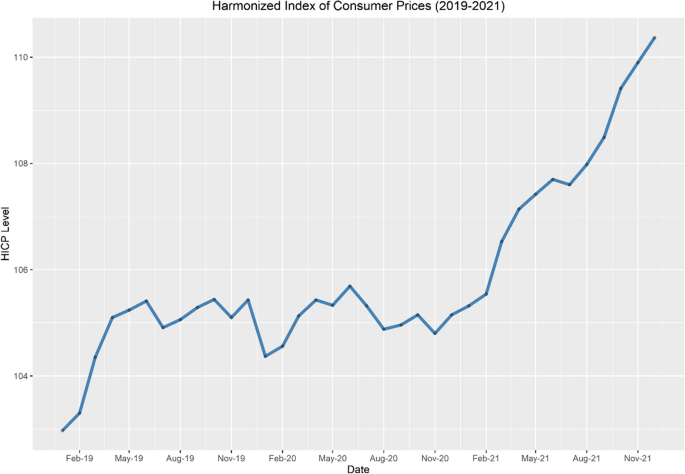

Firstly, economic policies categorized as ‘Other’ produced significant abnormal returns across the event window in Europe and the U.S.A. The categorization of ‘Other’ was assigned due to the relative infrequency of these types of events compared to the other categories, allowing an examination of the impact of isolated, but distinct announcements. In Europe, this consists of a single event on the 7th of July 2021 where the ECB’s Governing Council approved a new monetary policy strategy adopting a symmetric 2% inflation target over the medium term. From this announcement, the ECB (2021) stated that forceful and persistent monetary policy action would be required to avoid deviations from the inflation target. The findings suggest that this event resulted in a significant negative abnormal return over the event window for European banking stocks, with a CAAR of − 3.92% observed, with a sharp sell-off proceeding the announcement (Fig. 3). Notably, this came at a time when rising costs and worries of inflation dominated mainstream financial news outlets (Weber 2021; Dickler 2021), and as the Harmonised Index of Consumer Prices (HICP) in the European Union surged, reaching its highest level since the GFC (Fig. 5). As Solnik (1983) finds across all stock markets, as measures of inflation in the economy rise, a historical negative relationship with stock markets is observed through the Geske and Roll (1983) model, whereby inflation expectations are inextricably linked with stock market returns. Similarly, Asprem (1989) also investigated this relationship between stock prices and economic variables, finding that both inflation and interest rates were inversely related to stock prices. While such long-run analyses uncover this negative association, the immediate impact of inflation announcements may also trigger a stock market reaction as evidenced by the results in this analysis. In this case, a forceful announcement of inflation expectations and targets may be indicative of future economic measures necessary to curb economic conditions in the wake of unsustainable rising inflation (Reynard 2007).

While the announcement in question appears neither independently positive nor negative, the economic state of the market environment at that time must be considered. Knif et al. (2008) examine the reaction of stock markets to inflation news and found that the effect of inflation events on stock returns is conditional on whether investors perceive inflation shocks as good or bad in different economic states. Throughout 2021, as inflation measures began to increase month-on-month (Fig. 5), financial markets continued to soar. With this, it can be stated that the economy was still in an expansionary phase during this period. McQueen and Roley (1993) suggest that positive surprises in industrial production would be perceived by stock investors as “good news” during the Great Depression, but “bad news” in times when output and employment were high.

Extending this logic to the current market environment, we hypothesize that despite the expansionary economic phase observed in 2021, emerging news on inflation and positive inflation expectations were perceived as bad news by stock markets. Such events directly signalled an increased probability of central bank interventions in the future, such as increasing interest rates, decreasing growth rates, and a slowing economy. A key tool in a central bank’s arsenal to tackle sustaining inflation rates is the targeting of future interest rates. As such, this announcement of a new inflation target by the ECB signalled to financial markets the potential for a more hawkish stance in the future. As the literature finds, higher interest rates increase borrowing costs for both consumers and businesses, impacting the loan demand, and thus, the revenue and profitability streams of banks (Flannery 1981; Simonson et al. 1983). Akella and Greenbaum (1992) find this true, whereby a single unit change in interest rates causes on average, an opposite eight-fold change in bank stock returns. In other words, as interest rates increase, bank stock returns decrease, explaining our negative reaction of banking stocks to the announcement of future inflation-reducing policies.

On the other hand, economic announcements categorized as ‘Other’ in the U.S.A. were exclusively related to Federal Reserve credit and intraday credit limit announcements. This refers to the short-term funding of credit institutions and member banks by the Federal Reserve in order to provide and maintain liquidity and reserve requirements. Such measures ensure a steady flow of funds in the money market between banking institutions and consumers. The first announcement (23/04/2020) by the Federal Reserve Board increased the availability of intraday credit, suspended intraday credit limits, waived overdraft fees, and announced a streamlined process for secondary credit institutions to request intraday credit. The second announcement (01/10/2020) was similarly positive in sentiment, announcing additional temporary actions aimed at increasing the availability of intraday credit on both a collateralized and uncollateralized basis. A significant CAAR of + 3.98% was observed in response to these policy announcements, with positive cumulative returns observed on the three days following the event (Fig. 2). These results reaffirm the market sentiment surrounding credit and liquidity risks within the banking sector during the pandemic. As COVID-19 took hold and economies shutdown, corporate liquidity began to dry up. Barometers of liquidity and credit risk, such as the LIBOR-OIS and TED Spread, rose to their highest level seen since the GFC of 2007–2009 (OECD 2021). Meanwhile, companies began drawing on short-term credit lines in order to shore up balance sheets, with over $120 trillion drawn on by European and American companies in less than one month (Platt et al 2020). As pandemic-induced shutdowns took hold and consumer demand diminished, corporations drew increasingly on short-term credit lines, and the demand for liquid assets thus increased significantly (Bank of England 2020). As such, positive and supportive announcements providing a reliable and consistent flow of liquidity to major banks resulted in a positive and significant abnormal return of + 3.98% across the 5-day event window. This echoes the findings of previous literature (Fiordelisi et al. 2014; Ricci 2015; Naik and Reddy 2021) who observed a similar positive reaction of stock prices in the wake of positive credit and liquidity events.

Interest rate policy announcements

Traditional financial theory suggests that stock markets should benefit from an environment of low interest rates and lower costs of lending, borrowing, and refinancing (Madura and Schnusenberg 2000; Vaz et al. 2008). However, our findings suggest that interest rate policy announcements triggered significant and negative abnormal returns in the U.S.A. only. It should be noted that while the Federal Reserve lowered the target rate on two occasions as the pandemic took hold, the ECB’s rates were instead maintained and remained unchanged throughout the period under analysis, arguably explaining the lack of significance observed for European banks. Evident in Fig. 3 for Europe is a distinct lack of stock market reaction in response to interest rate policy events. The results observed for the U.S.A. indicate that interest rate events had a contrary effect on US banking stock returns, with a CAAR of -1.03% observed in the 5-day event window surrounding the announcements. For the US, the events under analysis contain only announcements of interest rate reductions or maintenance of the target rates. Thus, the broad generalization that stock markets react positively to decreases in interest rates does not hold. It can be suggested that several sector-specific factors outlined below, explain this reaction.

A low interest rate environment such as that observed prior to the pandemic can present several challenges to the banking sector. In conventional periods, Hack and Nicholls (2021) find that low interest rates can, by proxy, increase banking profits through the promotion of economic growth and the subsequent increases in the demand for credit, consumer borrowing, and asset prices which will follow. However, Ulate and Lofton (2021) find that in economies with already low or negative interest rates, policy rate cuts can sharpy erode bank profitability as deposits by consumers become significantly curtailed. This is reiterated by Ampudia and Van den Heuvel (2022), who found that surprise policy rate reductions were detrimental to bank equity values. This is in contrast to periods of higher interest rates, which saw a 1% increase in banking sector stock prices in response to a 25-basis point reduction of the short-term policy rate. In the context of COVID-19, these findings are further echoed by Acharya et al. (2021) who find not only did banking stocks underperform other sectors in the financial market as the pandemic took hold, but banks decided to reduce term lending levels even after policy measures were implemented by central banks to support and ease market conditions. Furthering this argument, Borio and Hofmann (2017) provide evidence that monetary policy becomes less effective when interest rates are persistently low. As such, it appears the conventional inverse relationship between interest rate changes and stock prices does not hold for the case of the banking sector in the low interest rate environment observed during the pandemic. This is evidenced by the under-performance of banking stocks relative to their domestic markets during COVID-19 (Demirguc-Kunt et al. 2021), and the negative CAAR of − 1.03% observed surrounding the announcement of interest rate reductions in this analysis.

Foreign exchange/foreign currency deposit requirement ratio announcements

Foreign exchange liquidity measures and deposit requirement ratio adjustments can play a pivotal role in alleviating strains in foreign currency markets during times of crisis. While all markets were significantly affected around the world by the COVID-19 pandemic, emerging markets, arguably more susceptible to currency value fluctuations and foreign investment freezes, suffered significantly higher exchange rate volatility. As stated above, as global liquidity tightened at the beginning of the pandemic and companies drew increasingly on short-term credit lines, even profitable companies were exposed to a significant risk of liquidity shortfall (Demmou et al. 2021). As such, asset prices plunged in both developed and emerging markets as foreign investors liquidated their assets in order to shore up domestic liquidity. With this, large-scale capital outflows took place with an influx of domestic currency, contributing to local currency depreciation. Hofmann et al. (2020) found that as the pandemic took hold, amplified losses were experienced in emerging markets as local currency spreads and exchange rates moved in lockstep with increasing portfolio outflows and bond yields. As foreign investors sold their assets, foreign currency reserves flowed out of the country, resulting in an excess supply of the now-depreciated domestic currency. The flow of funds away from emerging markets in the early stages of the pandemic exceeded $120 billion, amounting to more than the GFC and amounting to more than 1% of the GDP for many emerging markets (De Bock et al. 2020).

With this increased susceptibility of emerging markets to foreign currency and liquidity volatility, it is unsurprising that China experienced abnormal returns surrounding foreign exchange liquidity measures during the pandemic period. Positive CAARs of + 1.170% and + 1.540% were observed in response to foreign exchange liquidity and foreign currency deposit measures, respectively. The positive impact of these events is evident in Fig. 4 as CARs grew day-on-day following the announcement. Providing stable liquidity to financial markets, the PBoC initiated and extended bilateral currency swap agreements with South Korea, Thailand, Canada, Turkey, Japan, and England in order to maintain adequate foreign currency reserves and to promote lending to domestic banks. In such agreements, the central bank will obtain foreign currencies using their domestic currency as collateral, thus boosting reserves that can be used to lend and provide liquidity to banks and businesses. Compared to the Federal Reserve and ECB, currency swap agreements are a relatively recent tool employed by the PBoC, with the momentum of swap agreements picking up significantly after China announced its ‘Silk Road’ initiative in 2013 (Yelery 2016). As an emerging economy, the deployment of such liquidity and crisis management tools had an expected positive impact on banking stock returns following the announcement. Not only do such measures provide liquidity and reserve stability to financial markets, but Yelery (2016) also finds that in the case of China, these agreements are becoming an additional layer in an already multi-layered global safety net, globalizing China’s domestic currency and operationalizing China’s internationalization, without the interference and implications of currency volatilities.

While most emerging markets experienced amplified losses and a depreciated currency during the pandemic, the Chinese Yuan in fact strengthened over 2020 and 2021, rising 9.5% against the dollar between January 2020 and December 2021 (Fig. 6). However, due to the complex trade balances between China and the rest of the world, and the prioritization of imports, exports, and global positioning of the Yuan at play for China, an appreciating Yuan presented several benefits, but also risks. While Lizondo and Montiel (1989) and Krugman and Taylor (1978) state that currency appreciation and depreciation are neither contractionary nor expansive, traditional economic theory would dictate that as a currency appreciates, exports become more expensive as domestic goods increase in value relative to their foreign counterparts. As such, a stronger Yuan makes imports cheaper. With China’s ambitious infrastructure plans and industrial policies (Made in China 2025 and China Standards 2035 Plan, for example), cheaper imports would provide a countermeasure against the rising costs of input commodities, a major industrial risk in a post-COVID inflationary environment (Igan et al. 2022). However, while some relief through an appreciating currency may be felt, China is, and always has been a trade surplus country (Talalova and Tian 2022). As such, in a trade surplus economy, an appreciating currency that results in cheaper imports and more expensive exports may not be conducive to growth. Zhang (2009) investigates the nexus of Chinese currency appreciation, output growth, and inflation, finding that both moderate and sharp appreciations of the currency lead to negative shocks in economic growth for China.

As the Yuan appreciated throughout 2020 and 2021, the PBoC announced an increase in the foreign exchange requirement ratio on two occasions throughout the pandemic, from 5 to 7% on 10th May 2021, and 7% to 9% on 6th December 2021. With both measures, the PBoC stated it aimed to support liquidity and reduce the supply of dollars and other currencies onshore, thus putting pressure on the Yuan to depreciate. Both events resulted in a positive shock to banking stocks, with CAARs of 1.54% observed across the event 5-day window surrounding the announcements. Despite making it more expensive for banks to hold dollars, the policy announcements signalled a clear awareness and discomfort of the PBoC to the appreciation of the Yuan. As such, it can be argued that a definitive macroeconomic stance and vision for a weaker Yuan and cheaper exports was digested positively by financial markets amid a surge in the currency’s value. For the U.S.A. and Europe, no such events surrounding Foreign Currency Deposit Requirement Ratios were recorded.

Lending operations announcements

Throughout the pandemic, the Federal Reserve, ECB, and PBoC all engaged in liquidity assistance and credit provision measures through lending operation initiatives. Announcements by the Federal Reserve focused primarily on supporting and extending daily overnight repo operations across short-term durations, alongside new lending programs tailored to supporting the liquidity, credit, and asset requirements of various financial sector segments (Cantu et al. 2021). Additionally, the announcement of the Pay-check Protection Program Liquidity Facility is included under this scope. Similarly, in the case of China, there was a strong focus by the PBoC to maintain reasonable and adequate liquidity in the banking system through the use of reverse repo operations. Baldwin and Weder di Mauro (2020) outlined the almost unlimited “quantitative easing” provided by the Federal Reserve and ECB during the pandemic, which included purchases of government bonds, commercial paper, and mortgage-backed securities. Meanwhile, in China, a stronger focus was placed on providing liquidity and incentivizing lending to small and medium-sized businesses. Funke and Tsang (2020) reveal China’s contrasting policy approach, instead focusing on containing the nation’s debt pile. The targeted macro stimulus policies of the PBoC, therefore, contrast with the more extreme monetary and fiscal policies implemented by both the Federal Reserve and the ECB. The PBoC’s focus on providing immediate credit and liquidity to small and medium-sized businesses indicates an ultimately milder policy response when compared to the other regions examined.

For the case of the ECB, while immediate and short-term liquidity measures were provided to financial markets, 8 of the 10 events compiled in this analysis made reference to TLTRO (Targeted Longer-Term Refinancing Operations) or PELTRO (Pandemic Emergency Longer-Term Refinancing Operations), the latter which only commenced in May 2021. Unlike both the Federal Reserve and PBoC, no distinct reference to overnight reverse repo operations or shorter-term overnight financing was evident in the ECB’s announcements. Instead, a focus on the stability of liquidity conditions through the targeting of longer-term operations was evident. Given the short-term market focus of this study and the 5-day event window, the longer-term sentiment apparent in the ECB’s announcements may explain the lack of abnormal returns observed for European banks in response to these announcements. However, in the case of the US and China, the support of liquidity, credit, and overall stability in the banking system as a result of central bank policies was not reflected by way of abnormal positive returns either. In fact, negative CAARs were observed for the US and China of − 1.66% and − 0.45%, respectively in response to lending operations announcements.

Figure 7 below illustrates the distribution of announcement categories in all three regions over 2020 and 2021. A salient point to note is the abundance of all announcement categories in the early months of the pandemic. In particular, there is a distinct clustering of lending operations announcements in the first 6-months of 2020, a time of significant concurrent financial market volatility. In the case of China, 4 of the 9 announcements occurred before May 2020. This increases to 6 of the 10 announcements by the ECB, and 19 of the 39 announcements by the Federal Reserve. As such, despite the positive sentiment and tangible support that the announcements provided, these announcements came at a time of significant market uncertainty. Figure 8 below illustrates the performance of the benchmark indices used in this analysis during this period. From both Figs. 7 and 8, it is clear that the clustering of announcements occurred alongside a significant decrease in stock markets as the pandemic took hold. It appears that despite these announcements, the addition of stable and adequate liquidity into the banking system at these early stages of the pandemic was not reflected in the form of immediate positive abnormal returns. On the contrary, banking sector stocks suffered an abnormal negative return in response to these events which occurred at a time when global markets were in a state of widespread downturn. This is in-line with the current evidence that banking sector stocks underperformed significantly relative to other sectors as the pandemic took hold (Aldasoro et al. 2020; Acharya 2021). However, this does not suggest an ineffectiveness of the policy interventions which were implemented. In fact, monetary policy has been found to be more potent during financial crises, reducing the likelihood of adverse feedback loops (Mishkin 2009) and preventing deeper recessions (Bech et al. 2014). In the context of COVID-19, this importance is echoed by Casanova et al. (2021) who outline how central banks provided stability and assurance to the banking sector, strengthening lending capacities and incentivizing further lending. While the importance and effectiveness of these monetary policy interventions are clear, this benefit was not realized in the short 5-day event window used in this analysis. Further research in this area should expand on this 5-day trading-centric event window and implement a longer-term window in order to capture the tangible macroeconomic benefits of such policy actions.

Reserve policy